Varicose Vein Treatments See Radical Insurance Companies Payer Shift

Varicose Vein Center’s Treatments Increase by 1600%

At least in the world of varicose veins, for women there is no venous envy.

For health insurance companies, there is no venous envy either. In their mind’s eye, varicose vein treatments are a blight on their bottom line.

The reason for this is twofold. The first reason is that abnormal, painful and enlarged veins are very common. Over fifty million people in this country have varicose veins. Over one million Americans have venous ulcers.

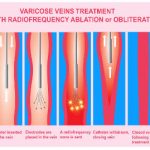

The second reason is that the number of varicose vein treatment centers has increased 1600% over the past ten years. Minimally invasive catheter and laser techniques have replaced traditional stripping surgery. Some varicose vein treatments and testing is being done unnecessarily by entrepreneurs.

Why Are Insurance Companies Approvals for Varicose Veins Getting So Tough?

This revolution in varicose vein treatment techniques started about fifteen years ago.

Surgeons are no longer the only specialists who can treat varicose veins. Nearly any doctor in any specialty can now legally treat varicose veins even with no training at all.

This is happening at an alarming rate. Insurance companies are cracking down to stop the avalanche of insurance claims that are a result of these forces.

Unqualified varicose vein doctors are performing unnecessary vein procedures. Unnecessary Doppler ultrasounds are done for profit.

The following description of the current state of vein care is being seen much too frequently. Respectable vein specialists are aware of this type of abuse.

The Intersocietal Accreditation Commission was created to police the “bad eggs”. Unfortunately, only in Massachusetts is compliance with a strict national standard of varicose vein care mandatory.

A Doctor’s Plea Against Insurance Companies Radical Payer Shift

Just to be clear: this blog is a plea for all health insurance companies to reexamine their present and future varicose vein treatment policies.

I hope that it will also raise awareness so that the most effective varicose vein treatments can continue.

Lately, this trend does not allow doctors to treat varicose veins in the best manner that they see fit. This is rapidly accelerating.

Insurance companies are arbitrarily denying needed care and options for varicose vein treatment. Their stand is that the data is unsupported.

The truth is that they simply don’t want to pay for these modern and scientifically proven techniques.

For example:

- Expensive sclerotherapy medicine is not covered at all.

- Medicare no longer covers support stockings at all.

- Only about half of all insurance companies cover support stockings.

- Some insurance companies will not pay for interventional treatment for varicose veins for adults whose body mass index does not stay below 30 for three months. Body mass index is a measure of obesity.

Obesity results in increased hip and knee replacements, diabetes and hypertension.

Why discriminate against varicose veins where obesity is a common risk factor in their cause?

Some insurance companies will not cover sclerotherapy or the injection of solutions into veins unless a laser or ablation of the saphenous vein has been done first.

If the saphenous veins are normal, why deny varicose vein treatment when the large and painful varicose veins originate from another source?

It makes no medical sense at all.

Some people have veins that are so huge that they need to be removed at the same time that a laser is done. That procedure is called phlebectomy.

Otherwise, these large veins will clot off. When the clot dissolves, these veins will recur.

Some insurance companies are arbitrarily refusing to cover this inexpensive but necessary procedure at the time of the laser procedure.

Many people have varicose veins that branch from a vein in the groin called the accessory saphenous vein.

Denial of payment for claims for the appropriate laser ablation of the source of these veins is becoming commonplace. These are often the largest and worst cases of all varicose veins.

Treatment of these veins with ultrasound-guided sclerotherapy, which is the second best choice, has also been denied. This unnecessarily dooms the patient to recurring visits for the treatment of the same veins repeatedly.

Why Not Just Allow Doctors to Treat It Right the First Time?

You would think that proper varicose vein treatment in the first place would be less expensive. However, for insurance companies, that’s not how they see it.

I believe that in the future that insurance companies will not cover varicose veins at all unless they are associated with skin ulcers.

Many varicose veins problems will simply be “pushed down the road”.

People will be forced to “tough out” the pain, phlebitis, and bleeding because proper varicose vein treatment will be unaffordable.

It simply will not not a covered service under their health insurance plan.

Varicose Vein Treatment is Usually Palliative

Vein treatment is palliative in most cases.

That means if you live long enough, because of your genetics, you will make new varicose veins.

If they were treated inadequately because insurance companies won’t pay for what the doctor feels that you need, your varicose veins will come back sooner.

Taking away the varicose vein doctor’s best tools and treatment options is just like diluting the chemotherapy of a patient with cancer.

It is also analogous to golfing with only a driver and a putter in your bag.

Decreasing Insurance Coverage in Other Medical Fields

What happens in the varicose vein insurance world doesn’t stay in the varicose vein insurance world.

Insurance companies are cutting covered services in many other medical and surgical fields

Treatments for chiropractic care, breast reduction surgery, maternity care, and weight loss surgery are also being restricted.

For example, number of vasectomy referrals by primary care doctors is limited in some areas of the country.

Insurance companies are shifting costs of expensive drugs and stents to you while at the same time increasing your premiums.

The result is that your overall health deteriorates.

You will require more services down the road.

Changes that will affect you include:

- Many effective prescription drugs will be considered too expensive by health insurance companies.

- Coverage for effective and proven costly cancer treatments will be denied as being experimental.

- Most alternative medical treatments are no longer covered.

- Cardiac stents are already restricted.

- Home health care has been cut back.

- Mammograms are being done less frequently.

- Prostate cancer screening blood tests are restricted.

- Colonoscopies, CT, and MRI scanning early in the history of headache or early back pain have become more closely scrutinized.

- One insurance company has started requiring special approval for all non-vaginal hysterectomies. (Vaginal hysterectomies are less costly.)

In the past eight years, the average health insurance deductible has more than doubled from $584 to $1,217 for an individual.

Add to this co-pays, co-insurance and the price of drugs or procedures which are not covered by insurance companies.

This is overwhelming for many Americans.

People are skipping doctor recommended tests and follow-up exams as a result.

Conclusion

Contrary to popular belief, varicose veins aren’t just cosmetic.

The biggest threat to the treatment of varicose veins is radical insurance payer shifts.

Varicose vein procedures that are currently covered by most insurance companies often can no longer optimally treat your abnormal veins.

Restrictions and severe cuts in insurance policies are limiting your doctor’s options. Necessary procedures have been denied payment. Evidence based studies and consensus articles by experts in the field of veins are simply ignored.

As payers introduce high copayments and deny procedures to limit for varicose vein treatment, your overall health will deteriorate. Subsequently, more services will be required which will be covered even less.

This article is an attempt to educate the public on how the system for the reimbursement for venous disease is broken.

Until insurance companies come together with a universal plan, these arbitrary denials for varicose vein treatment will continue.

Arbitrary denials for necessary vein procedures can be remedied by a collective plan to optimize varicose vein care.

Kavic Laser & Vein Center accepts the following health insurance plans.

- Aetna

- Advantra

- Anthem/BCBS

- Cigna

- Coventry

- Devon

- 4Most

- Health America

- Health Assurance

- Health Plan of Upper Ohio Valley

- Humana

- Highmark/BCBS

- Medical Mutual

- Mon-Valley Health Plan

- Multi-Plan

- Tricare

- United Health Care

- Western Pennsylvania Electric (WPEE)

- UPMC

- All BC/BS plans